The Liquidity Challenge in Collectibles

$2.56T Assets (43% of Global Private Equity)

Trapped in Inefficient Systems

Imagine you own $1M in collectibles and need urgent liquidity:

- • Contact auction house → Wait 6-12 months

- • Pay 20-25% commission

- • Massive opportunity cost

- • Upload asset → 24-48 hours

- • Get liquidity, significantly lower fees

- • 90-180x faster

This isn't a niche problem: UHNW individuals hold 10.4% of wealth in collectibles, equivalent to $2.56T total assets, but 90% cannot be liquidated instantly.

Liquidity Comparison: Traditional vs RIVEX

Traditional Liquidation Process

6-12 Months⚡ RIVEX Process

24-48 Hours⚡ 90-180x Faster

Traditional timeline based on auction house industry average | RIVEX target based on internal process design

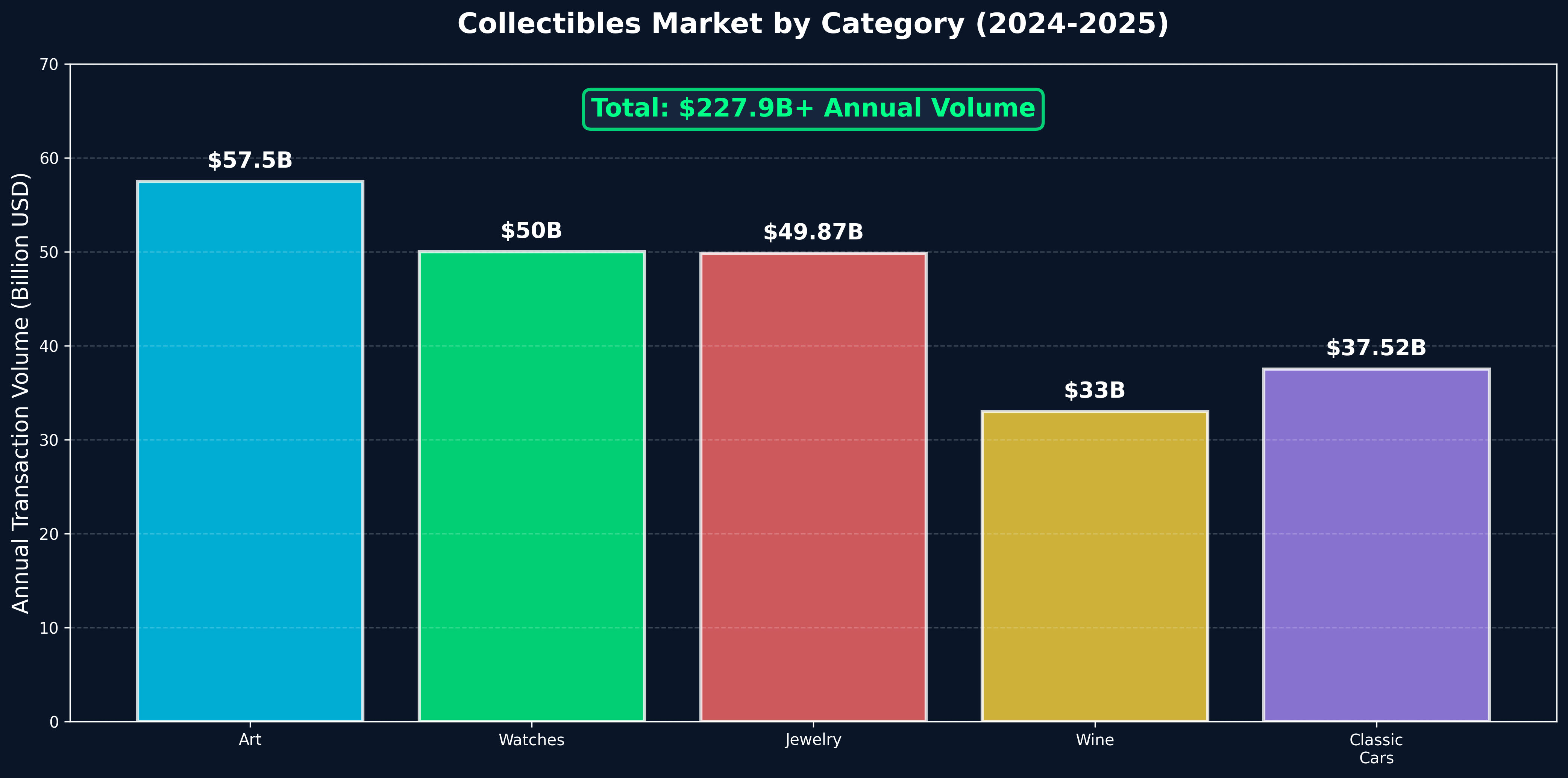

Global Collectibles Market

Source: Deloitte & ArtTactic 2025

RIVEX Target Liquidation

Compare: Private Equity 7-10 year lock-up

Annual Trading Volume (Est.)

Source: Art Basel & UBS 2025

An Active Market with Annual Transaction Volume Exceeding $125B

RIVEX covers all major collectible categories, providing comprehensive services for valuation, authentication, and collateralized financing.

The Three Major Pain Points of Traditional Markets

Trillions of dollars in assets are trapped in inefficient traditional systems

Liquidity Trap

Liquidity Trap

Actual Impact

Holding $1M in assets requires waiting over half a year to realize, plus paying $200-250K in commission

Information Black Box

Information Blackbox

Core Problem

Information asymmetry leads to extremely high transaction trust costs

Zero Capital Efficiency

Zero Capital Efficiency

Opportunity Cost

Holding $10M in collectibles cannot be used for reinvestment

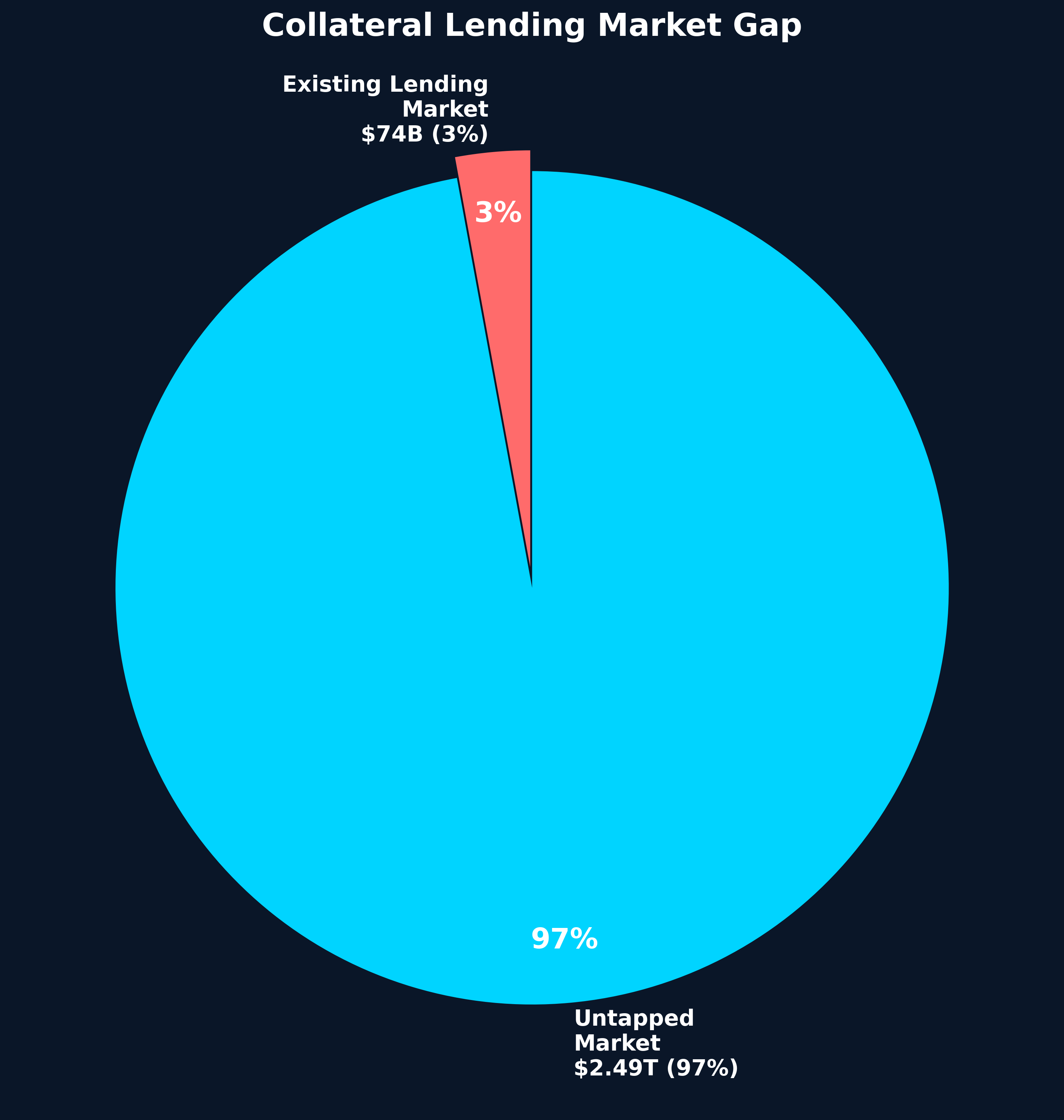

$2.5T+ Market Gap

The existing collateralized lending market covers only 3% of collectible assets; 97% of assets cannot be effectively financed

Source: Deloitte Art & Finance Report

Annual transaction volume of $125B+ (estimated) indicates an active market with strong demand for liquidity

The New Generation of Collectors is Reshaping the Market

Younger collectors view financial returns as the primary reason for collecting

Source: Art Basel & UBS 2025

Average allocation ratio for UHNW (up from 15% in 2024)

Source: Art Basel & UBS 2025

The Trinity of

Liquid Legacy

The Trinity of Liquid Legacy

"Let great assets be silent no more;

Let dormant wealth possess intelligence."

RIVEX.APP

Your Pocket Oracle

Your Pocket Oracle

From photo to valuation, instant identification

The world's first collectible AI brain

Trained on top auction data

RIVEX.TODAY

Born Digital, Forever Verified

Born Digital, Forever Verified

Verification today, liquidity tomorrow

Origin forensic physical scanning

Minting the digital passport for assets

RIV.CASH

Liquidity On Demand

Liquidity, On Demand

One-click release, funds instantly available

Instant Lending · Smart Sales

Putting dormant assets to work

App · Today · Cash

Intelligence · Verification · Liquidity

From your pocket, to the global market

This is RIVEX App.

Your Pocket Curator

From the moment you photograph a collectible with your phone, RIVEX INTELLIGENCE begins calculating global market trends for you

1. Snap it.

Snap it, and it enters your smart inventory

Create a collectible card with just one photo, automatically identifying the type (watch, wine, bag, shoes, artwork). Automatic card creation and inventory addition. This is the most Magic moment.

2. Value it.

Assign value and context to every collectible

Automatically populate brand, year, model, and provide market reference prices and valuation ranges. Establish "Your Collection Value Understanding Layer."

3. Manage it.

Your collection package finally becomes elegant

Manage your collection like a game inventory. Categorization, collections, tags, value distribution map. Your collection is "organized" and "empowered" for the first time.

"RIVEX doesn't just record collections; it makes collections truly become your life intelligence."

App Live Demonstration

See RIVEX in Action

```htmlRIVEX INTELLIGENCE

Your Collection's Omniscient Brain

Your Collection's Omniscient Brain

Proprietary Large Model based on global auction data

RIVEX transforms your collection into an "Omniscient Brain".

We integrate historical transaction data from top auction houses like Sotheby's and Christie's, combined with Vision AI, granting you expert-level understanding of your prized possessions.

Auction Insight™

Instantly retrieve global auction records and analyze the premium potential of your collection across different markets.

RIVEX Chat™

Unsure about the history of this wine? Want to know the story behind this watch's movement? Engage in deep dialogue with the AI anytime to gain encyclopedic knowledge.

RIVEX Sommelier™

"I have analyzed 3 top Burgundy and Bordeaux wines in your inventory for you:

🏆 Top Recommendation: 2015 DRC La Tâche ($6,250)

Xin Rong Ji's braised pork belly is rich in fat and sweet. The oriental spice and rose aromas of this wine will perfectly cut through the richness, and the silky tannins won't overpower the meat. A high score of 98 points, currently in its optimal drinking window. Suggest decanting 2 hours in advance.

💎 Alternative: 2010 Château Margaux ($1,850)

If you prefer a more elegant Bordeaux style, this perfect-score wine boasts rich fruit and perfect structure, also suitable for pairing with fatty meats. Better value, with a 12-month price increase of +12.3%.

🎯 Premium Choice: 2009 Château Lafite ($2,100)

Classic Left Bank Bordeaux, with powerful yet elegant tannins, suitable for guests who appreciate traditional French style. Rated 99 points, with excellent aging potential."

Domaine de la Romanée-Conti

Château Margaux

Château Lafite Rothschild

RIVEX Horologist™

"Based on your collection and the occasion, here are 3 options analyzed for you:

🎯 Best Choice: Patek Philippe 5196P Calatrava ($32,000)

The platinum case is extremely understated, aligning with the 'Old Money' aesthetic. The Breguet dial conveys respect for traditional craftsmanship, projecting an image of stability, punctuality, and lack of ostentation. Stable Value Retention +2.1%.

⏱️ Classic Alternative: Vacheron Constantin Patrimony ($28,500)

An equally discreet and elegant dress watch from a brand with a long heritage. The ultra-thin case is better suited for a suit cuff, and the price is relatively more accessible.

💎 High-End Selection: A. Lange & Söhne Saxonia Thin ($35,800)

The pinnacle of German watchmaking craftsmanship. The exquisitely hand-engraved movement will impress a European family office principal who appreciates fine watchmaking. Extremely discreet yet rich in substance."

Patek Philippe

Vacheron Constantin

A. Lange & Söhne

RIVEX Stylist™

"To pair with a black cocktail dress, I have analyzed 3 options from the inventory:

🎯 Best Match: Hermès Kelly 25 Sellier Gold ($28,500)

The Gold Epsom leather provides a warm highlight to the all-black outfit. The 25 size is light and elegant for a reception. The gold hardware perfectly echoes gold earrings. 12-month appreciation +15.2%.

👜 Classic Choice: Chanel Classic Flap Medium Black ($8,500)

All black with all black appears more composed, suitable for the low-key style of the art scene. The gold chain can be worn over the shoulder or carried by hand, offering greater practicality.

🌹 Eye-Catching Choice: Bottega Veneta Knot Clutch Burgundy ($3,200)

If you desire a more artistic flair, the burgundy clutch subtly complements the gallery environment, and the woven leather craftsmanship makes for a great conversation starter."

Hermès Kelly 25

Chanel Classic Flap

Bottega Veneta Knot

RIVEX Insight™

Concentration Risk

RIVEX ORIGIN (ORIGIN Terminal)

Forensic-Grade Physical Authentication

Forensic-Grade Physical Authentication Hardware

Eastern Philosophy

聚 (Gather) · Gathering all rivers, bringing thousands of assets to the sea

元 (Origin) · The Source of Origin, transforming static objects into capital

Metal Generates Water · Hardware belongs to Metal, Liquidity belongs to Water

Core Technology

0.001mm Micrometer-level Precision

360° Full-Matrix Light Field Scanning

Spectroscopic Analysis + Nanogram Weighing

From Physical Item to Digital Asset Passport

```htmlPhysical Assets

High-Value Collectibles

Luxury Watches · Fine Art

HD Scanning

RIVEX Origin

Micron-Level Precision

3D Modeling

Digital Twin

Complete Reconstruction

AI Authentication

Authenticity Verification

Condition Scoring

NFT Minting

Asset Passport

Permanent On-Chain Record

Physical Assets →

Origin HD Scanning →

3D Digital Twin →

AI Intelligent Authentication →

NFT Asset Passport

Every asset possesses a unique digital identity certificate, recording complete authenticity, condition, and historical data.

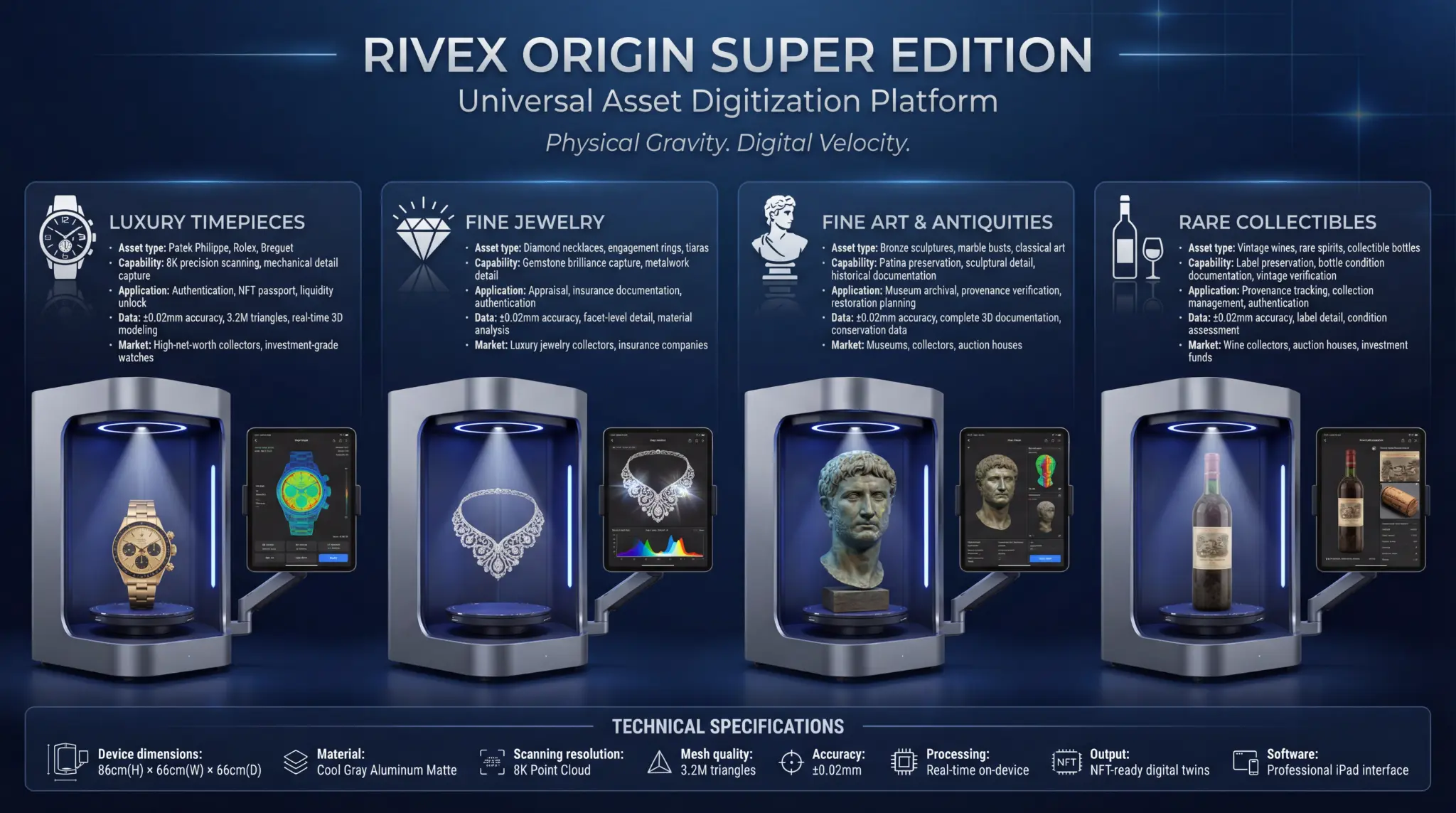

RIVEX ORIGIN SUPER EDITION

Real-time Scanning Visualization

8K Point Cloud · 19.5M Triangles · ±0.05mm 精度

RIVEX ORIGIN Hardware

86cm(H) × 66cm(W) × 66cm(D) · Cool Gray Aluminum Matte

Optical Scanning & 3D Modeling

Geometry · Depth · Texture · 3D Model Formation

Universal Asset Digitization Platform

Timepieces · Jewelry · Art & Antiquities · Collectibles

Core Technical Specifications

Ultra HD Scanning Results

Micron-level precision captures every detail, providing absolute basis for NFT minting

⚡ Capabilities Enabled by Origin

Ultra-high-definition imaging captures micron-level details, combined with AI recognition for precise authentication.

Automatically assesses asset condition and generates standardized scoring reports.

Minting NFTs based on high-definition 3D models, recording the asset's status.

Digital Twin + Blockchain

Digital Twin + Blockchain

Immutable Truth, Borderless Liquidity

Giving physical assets a perfect mirror image in the digital world, enabling global circulation through blockchain.

This is not a technology upgrade; this is an industry rebirth.

What is a Digital Twin?

Physical World

Physical Assets

Digital World

Digital Twin NFT

What does the RIVEX Digital Twin include?

Physical Fingerprint

- • 0.001mm Micron-level Scan

- • 360° Light Field Data

- • Weight, Dimensions, Material

Proof of Identity

- • AI Authentication Result

- • Origin Rating

- • Historical Provenance Record

Value Data

- • Real-time Market Valuation

- • Auction History Record

- • Liquidity Metrics

Proof of Ownership

- • Unique NFT Identifier

- • Permanent Blockchain Record

- • Globally Verifiable

The Complete Journey from Physical to Digital

STEP 1: Physical Rights Confirmation

Origin Terminal Scan

Generate 3D Digital Twin

AI Authentication + Scoring

STEP 2: DATA ON-CHAINING

Upload to IPFS

Hash value recorded on the blockchain

Permanently immutable

STEP 3: NFT MINTING

Invoke smart contract

Mint ERC-721 NFT

Bind physical asset

STEP 4: SMART CONTRACT MANAGEMENT

Vault custody contract

Marketplace trading contract

Lending protocol

STEP 5: GLOBAL LIQUIDITY

OpenSea, Blur trading

Uniswap liquidity

Aave collateralized lending

Ethereum + Polygon Dual-Chain Strategy

Ethereum

Mainnet (L1)

Polygon

Layer 2

Users do not need to worry about which chain they are on; the system automatically selects the optimal solution

Reshaping the Collectibles Industry

| Dimension | Traditional Method | RIVEX Method |

|---|---|---|

| Authenticity Verification | Relies on experts, subjective judgment | Origin scanning + AI, objective data |

| Proof of Ownership | Paper certificate, easily forged | NFT, permanent blockchain record |

| Transaction Process | In-person meeting, takes months | Online transaction, settlement in seconds |

| Cross-Border Circulation | Complex customs and taxes | Digital asset, borderless |

| Liquidity | Requires 6-12 months for monetization | Instant trading or collateralized lending |

| Transparency | Non-transparent pricing | Real-time global market pricing |

From Singular Ownership to Programmable Assets

1 Physical Asset = 1 NFT = Infinite Possibilities

Instant Trading

Seller lists → Buyer places order

Smart contract executes automatically

Completed in 2 seconds

Collateralized Lending

Hold $100K NFT

Borrow $60K against it

Physical asset remains in Vault

Fractional Ownership

$1M Watch

Fractionalized into 100 parts

$10K per share

Leasing & Usage

Holder leases out NFT

Tenant gains usage rights

Smart contract revenue sharing

RIVEX: From Product to Protocol

To give every great asset a digital life.

To enable every dormant fortune to flow freely.

This is not a technological upgrade; it is an industry rebirth.

RIVEX RATING SYSTEM

Standardize. Systematize. Liquidate.

Standardization · Systemization · Liquefaction

Whoever sets the standard controls the industry narrative.

RIVEX is not just a product; it is the architect of the RWA industry standard.

Through the RRS rating system, we transform non-standard physical assets into standardized digital assets.

Strategic Positioning

Moving from a single product to industry infrastructure, RIVEX establishes an irreplaceable competitive moat by defining the appraisal standards, scoring mechanisms, and tokenization protocols for RWA assets. When third parties adopt the RIVEX standard, we become the industry's de facto standard setter.

RIVEX Origin Condition Grading System

Digital Asset Passport

RWA Tokenization Protocol

Standard Promotion Roadmap

🏰 Competitive Moat

RIVEX SHIELD

Triple Protection for the Digital Vault

Solid as Rock, Deep as Water

Solid as a rock, deep and quiet like water

Technology Shield

Technology Shield

-

▸

Blockchain Immutability

Every asset change is permanently recorded on-chain -

▸

Multi-Signature Mechanism

Critical operations require authorization from multiple parties -

▸

Open Source and Auditable

Core contract code is public and transparent

Physical Shield

Physical Shield

-

▸

Bank-Grade Custody Standards

Partnerships with top-tier custodial institutions -

▸

Temperature and Humidity Controlled Environment

Professional art-grade storage facilities -

▸

24/7 IoT Monitoring

Real-time tracking of asset status

Insurance Shield

Insurance Shield

-

▸

Full Coverage Underwriting

Collaboration with international top-tier insurance companies -

▸ 1:1 Rigid Redemption

Physical assets and digital rights are fully corresponding -

▸

Extreme Scenario Guarantee

Even if the internet disappears, your assets remain secure

"At RIVEX, your assets enjoy Triple Protection:

The immutability of code, the physical security of the vault, and the full compensation from the insurance company.

Even if the sky falls, your collection remains."

The High-Speed Rail for Dormant Assets

From the hands of users, to the realm of value.

RIVEX has built a standardized infrastructure system for the global trillion-dollar market of non-standard dormant assets.

RIVEX App — User Entry Point

Snap It · Value It · Manage It

The critical first step to acquiring a large volume of user and asset data

Take photos and upload to create an asset profile

AI intelligent valuation, giving you basic + deep understanding of your assets

Centralized management of all collections

User manual input + AI automatic completion = The largest RWA asset database

Layer 1: Standardization (Entry Layer)

The first step to eliminating information asymmetry

RIVEX Origin

High-precision hardware equipment, achieving micron-level identification. Scans dial details, wine bottle vintage, and art brushstrokes, establishing ultra-high-definition 3D modeling and digital twin passports.

AI Authentication Engine

Vision AI intelligent recognition, accuracy 95%+. Automatically identifies brand, model, condition, and provides instant authenticity verification. Users must photograph the physical item + full set of accessories (purchase certificate, packaging box, etc.) to supplement information like vintage.

Quantitative Rating System

Establishes a verifiable digital identity. Every collection piece has a unique ID, rating record, and proof of ownership, fully traceable.

Layer 2: Systematization (Infrastructure Layer)

Building friction-less trading infrastructure

Global Third-Party Network

Integrates auction houses, dealers, and appraisal institutions to obtain the most accurate market data. Also serves as a backstop network, ensuring liquidity and asset value.

AI Connection Engine

Uses AI technology to connect all merchants, enabling intelligent matching. Automatically connects lending needs, buying/selling intentions, and liquidity management.

RIVEX Vault

Bank-grade physical facilities with IoT monitoring. Future construction includes Smart Wine Cellars, Watch Safes, and Art Storage, providing a secure haven for assets.

Layer 3: Financialization (Value Release Layer)

Unlocking the liquidity of dormant assets

RIVEX Finance

rivex.finance

A private banking experience on your mobile phone. View real-time valuation and available credit limit for each asset, and apply for collateralized loans or consignment sale advances with a single click. Supports one-click rollover or early repayment, managing RWA lending like a bank account.

RIVEX Market

riv.exchange

The world's first "no-counterfeits" trading market. Buyers purchase digital asset ownership (NFT), completing transactions without physical delivery. Through data analysis and AI recommendations, every " treasured item" can find its " patron."

RIVEX Vault

rivex.co

Physical Vaults interact with smart systems, transforming physical items into collateralized assets that can be withdrawn. Construction of Smart Wine Cellars, Watch Safes, and Art Storage enables dynamic LTV monitoring and rapid monetization.

Layer 4: Ecosystem Empowerment (Circulation Layer)

Continuously empowering the entire ecosystem

Reduce Friction Costs

Traditional auction houses charge 10-25% in fees, which is the cost of information asymmetry. RIVEX significantly reduces transaction costs through standardization and transparency.

Eliminate Information Asymmetry

Provide transparent pricing and real-time data, enabling everyone to make informed decisions. Democratizing asset trading by no longer relying on connections and experts.

Empower Traditional Institutions

RIVEX does not compete with auction houses, but provides infrastructure for them. Making the entire ecosystem more efficient through standardization and digitalization.

Maximize User Value

Making dormant assets truly liquid

Project HAWK: AI-Driven Media Matrix

From traffic acquisition to product conversion, from user education to ecosystem enablement.

Precisely capture High-Net-Worth Individuals (HNWIs) through a tripartite strategy: "AI Content Production + KOL Matrix + Precision Targeting."

AI-Driven Content Production Engine

RIVEX is not just a product; it is a Content Production and Distribution Platform. Utilizing AI technology, we can produce hundreds of high-quality content pieces daily, covering finance, collectibles, investment, and other fields, establishing industry authority.

Finance and Macro Information Channels

Establish the RIVEX proprietary financial media matrix. Attract investors focused on asset preservation through macro-economic analysis and alternative asset allocation advice.

Vertical KOL Alliance

Sign Key Opinion Leaders (KOLs) in luxury watches, fine wine, and art. Address collector pain points through topics like "Collection Management" and "Data Digitization."

Precision Targeted Advertising

Target High-Net-Worth Individuals (HNWI) in Hong Kong/Singapore with LinkedIn and Meta ads. Core appeals: "Monetizing Dormant Assets" and "Collateralized Lending."

Initial Battleground: Asian Golden Triangle

Targeting the three core cities with the highest wealth density and deepest collecting culture in Asia.

-

🇭🇰

Hong Kong (Pilot A)Global luxury watch trading hub, concentration of auction houses.

-

🇸🇬

Singapore (Pilot B)Web3 financial center, abundant capital.

-

🇨🇳

Shenzhen (Pilot C)Asia's largest luxury inventory market, urgent liquidity demand.

Revenue Strategy and Financial Projections

Acquire customers through the HAWK strategy and convert them progressively. Based on reasonable user growth assumptions and conversion rates.

Funnel-Based Profit Model

1. Free Users (HAWK Traffic)

CAC: $15 (Content) - $100 (Ads)

Paid Subscribers

SaaS Subscription ($9.9 - $29.9/mo)

- • AI Identification Advanced Models

- • Multi-Asset Portfolio Management

VIP Ecosystem

Offline Verification and Financial Services

- • Minting Fee Asset On-chaining

- • ORIGIN Scanning Verification

Revenue Streams

App Layer

- • Subscription Fee $9.9-99/year

- • Data Reports $10-50

- • API Call Fees

Scanning

- • Scanning $50-100/time

- • Equipment Sales

- • Data Storage

Financial

- • Lending Interest Margin 3-10%

- • Transaction Fee 1%

- • Insurance Rebate 5-10%

Partner

- • Auction House Commission

- • Risk Control API

- • Data Licensing

User Growth Model

Annual Revenue Growth

Roadmap: 2025 - 2029

System Optimization & Database Expansion

- ✓ Internal testing of core App features completed

- ✓ ORIGIN-1 hardware prototype assembly completed

- ✓ Project HAWK content matrix launched

Three-City Pilot & Ecosystem Closed Loop

- → Official launch in Hong Kong, Singapore, and Shenzhen markets

- → RIVEX Finance (Lending) and Vault (Storage) go live

- → Deploy first batch of ORIGIN Scanning Centers (3-5 sites)

Regional Expansion & Fund Issuance

- → Enter Japan, Korea, and Taiwan markets, expand asset classes

- → RIVEX RWA Index Fund fundraising (Target $50M)

- → Apply for Hong Kong SFC Licenses 1/4/9

Globalization & Industry Standard

- → Enter major European and American markets (London/New York)

- → Total AUM surpasses $500M+

- → ORIGIN becomes the de facto industry standard

Key Milestones

From Product to Ecosystem, from Standard to Fund

Detailed Financial Forecasts & Revenue Breakdown

Clearly presenting each revenue stream and calculation logic based on reasonable user growth assumptions and conversion rates.

User Growth Model

Annual Revenue Comparison

Annual Revenue Breakdown (Click on the bar chart above for details)

2026 Revenue

Focus on SaaS Subscriptions + Initial Minting

Calculation: 2,000 × 17.6 × 18 = $633.6K

Calculation: 150 × 700 + On-chain Fee = $160K

2027 Revenue

Ecosystem Expansion, Financial Services Launch

Calculation: 10,000 × 17.6 × 18 = $3.17M

Calculation: 900 × 700 + Value-Added = $1.0M

Calculation: $700K + $500K + $100K

2028 Revenue

Full Ecosystem Operation, Comprehensive Financial Services Rollout

Calculation: 32,000 × 17.6 × 18 = $10.1M

Calculation: 3,200 × 700 + Value-Added = $3.5M

Calculation: $2.7M + $2.0M + $0.5M

Company Valuation Growth Projection

Calculated based on the Revenue Multiple method, referencing valuation levels of comparable RWA projects

Valuation Methodology

Based on the company's Annual Recurring Revenue (ARR) multiplied by an industry-standard multiple. Early-stage SaaS companies typically use 10-15x, Fintech companies use 8-12x, and mature RWA platforms use 6-10x.

📊 Key Metrics Summary

RIVEX LEGACY

Value Across Cycles

Own the Moment, Pass the Legacy

Own the Moment, Pass the Legacy

Pain Points of Traditional Collectibles

- ❌ Paper certificates yellow and get lost

- ❌ Maintenance records are difficult to trace

- ❌ Inheritance process is complex and prone to disputes

- ❌ Authenticity relies on subjective expert judgment

RIVEX's Solutions

- ✅ Digital Passport: Lifetime ID, never wears out

- ✅ Complete Record: Every moment from creation to circulation

- ✅ Smart Inheritance: One-click heir designation, secure and worry-free

- ✅ Scientific Authentication: AI + Hardware, objective and trustworthy

Investment Philosophy That Transcends Cycles

RIVEX does not encourage short-term speculation; we advocate for:

Long-Termism

Long-termism

- 📈 Cycle Resistance: Physical assets do not go to zero

- 🌊 Stable Appreciation: Historical data shows top collectibles yield 8-12% annualized returns

- 🧘 Peace of Mind: Avoid chasing highs and selling lows; enjoy the pleasure of ownership

Generational Wealth

Generational Wealth

- 👨👩👧👦 Family Asset: From "My Collection" to "Our Family Heirloom"

- 📚 Cultural Education: Enabling the next generation to understand the value of art, history, and craftsmanship

- 🌟 Spiritual Wealth: Beyond the material, transmitting taste and wisdom

"Allow your collection to achieve eternal life in the digital world."

Give your collection eternal life in the digital world.

Join the Seed Round

We are raising a seed round to accelerate product development, expand to key markets, and scale our growth initiatives.

Password protected - Contact us for access